Income Tax Number Malaysia Example

There are no other local state or provincial.

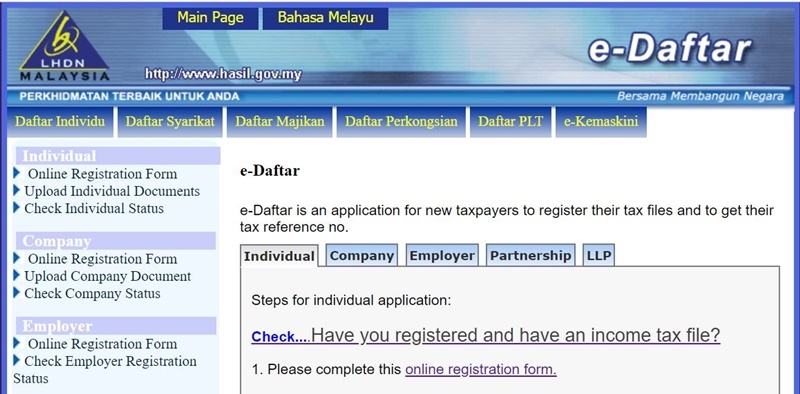

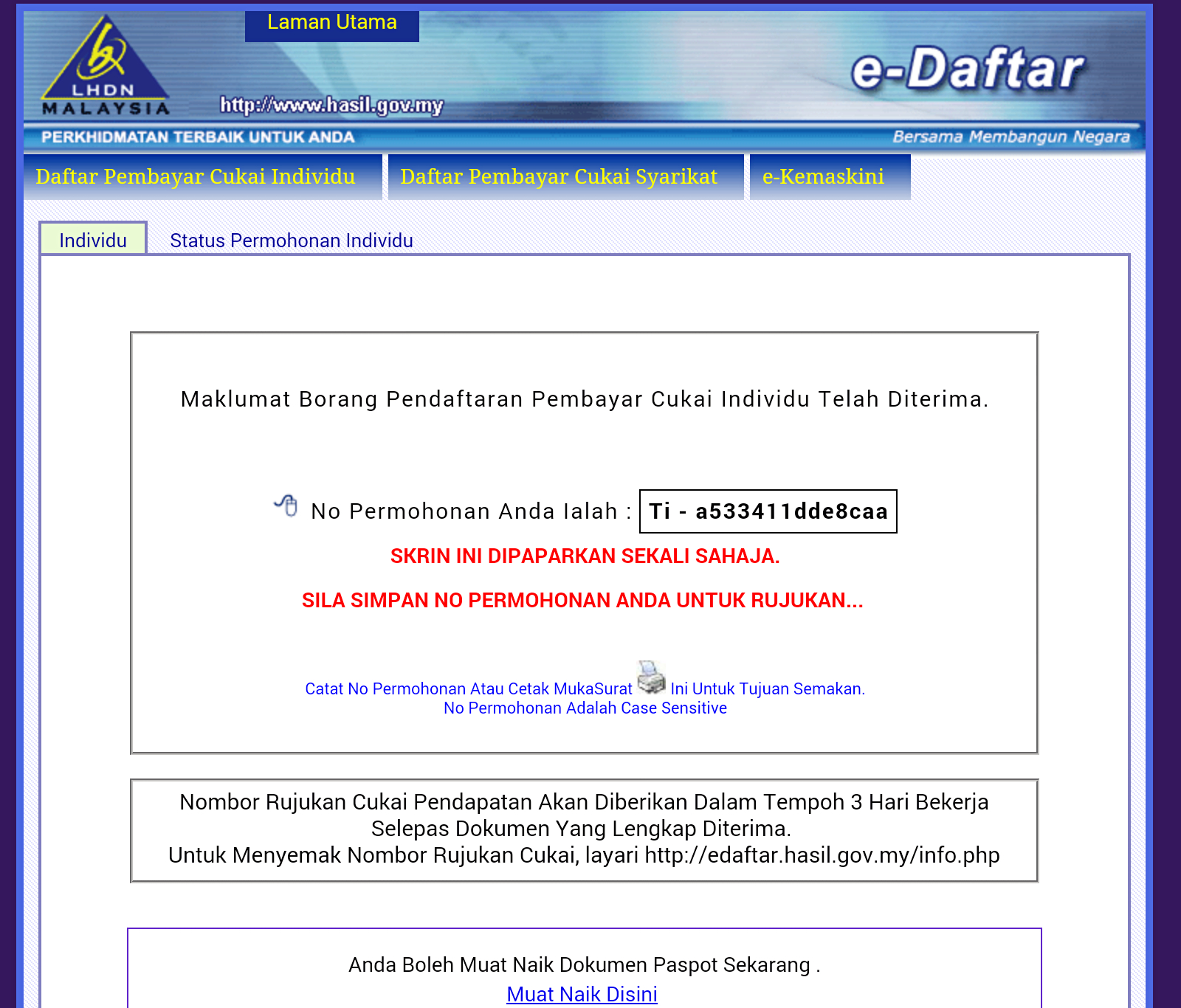

Income tax number malaysia example. All tax returns must be completed and returned before april 30 of the following year. The more you reduce your chargeable income through tax reliefs and such the lesser your final tax amount will be. This unique number is known as nombor cukai pendapatan or income tax number. If you are newly taxable you must register an income tax reference number.

For example let s say your annual taxable income is rm48 000. Read together any income that is derived from malaysia as defined is subject to income tax in malaysia. Lembaga hasil dalam negeri malaysia classifies each tax number by tax type. Malaysia information on tax identification numbers section i tin description malaysian income tax number itn the inland revenue board of malaysia irbm assigns a unique number to persons registered with the board.

Based on this amount the income tax to pay the government is rm1 640 at a rate of 8. Register at the nearest irbm inland revenue board of malaysia lhdn lembaga hasil dalam negeri branch or register online at hasil gov my. The inland revenue board of malaysia malay. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields.

Provides audit tax advisory services. 603 78827500 and address is jalan stadium ss 7 15 kelana jaya 47301 petaling jaya selangor malaysia the income tax department of malaysia works under the k p m g which is a global network of professional firms providing audit tax and advisory services k p m g. Provide copies of the following documents. No other taxes are imposed on income from petroleum operations.

For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing. In malaysia the tax year runs in accordance with the calendar year beginning on january 1 and ending on december 31. The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing. Sg 12345678901 tax reference.

Persons employed to work on oil rigs in the south china sea off the coast of east malaysia are flown out to the oil rig from hong kong to work for two weeks and flown back to hong kong to rest for two weeks. Your income tax number consists of a tax reference type of 1 or 2 letter code followed by a 10 or 11 digit tax reference number. To file income tax an expatriate needs to obtain an income tax number from the inland revenue board of malaysia irb. Income tax office malaysia contact phone number is.

The most common tax reference types are sg og d and c. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in malaysia.