Income Tax Calculator Ay 2019 20 Finotax

Interim budget 2019 2020 speech has been delivered by piyush goyal minister of finance on february 1 2019.

Income tax calculator ay 2019 20 finotax. The union budget 2019 20 has proposed full tax rebate for income up to rs. The taxable income will be worked out after making applicable deductions if any. Calculate your income tax online for fy 2020 21 ay 2021 22. The income tax department appeals to taxpayers not to respond to such e mails and not to share information relating to their credit card bank and other financial accounts.

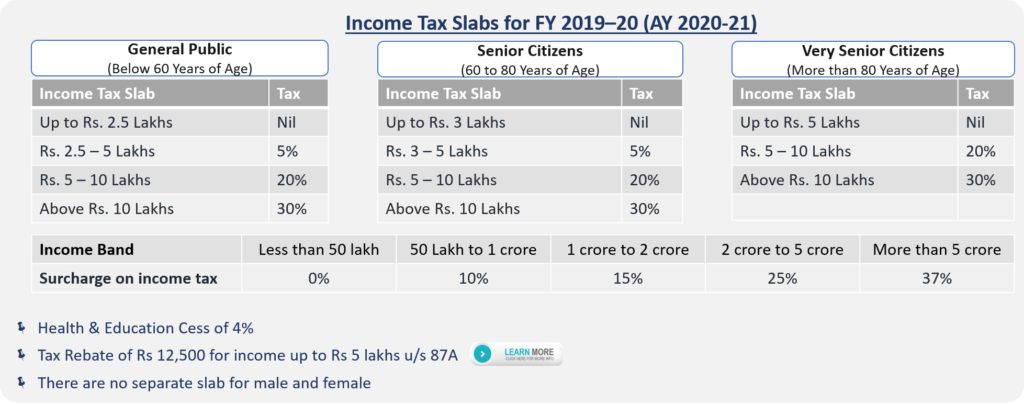

As per as 22 timing differences are the differences between taxable income and accounting income for a period that originate in one period and are capable of reversal in one or more subsequent periods. Ay 2020 21 and ay 2021 22. Easily calculate income tax surcharge health education cess education cess taxable income incomes taxable at various rates marginal relief on surcharge and net surcharge if taxable income exceeds 50 lacs 1 crore 10 crores tax liability and income net of. Income tax calculator for the financial year 2019 20 for salaried individuals in india in excel.

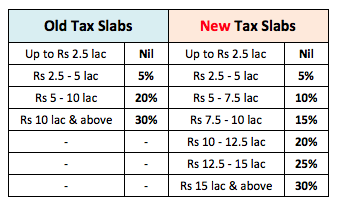

Find step by step guide to calculate income tax from salary house property and capital gains. Tax calculator 2020 which helps determine the tax payable by individuals for the year 2019 20 considers tax rates levied as follows. Tax planning in the beginning of the financial year is always better instead of doing that at the end of the year in hurry. Though no changes has been made in made in tax slabs yet a rebate of maximum amount of rs 12500 has been allowed to persons having taxable income up to rs 500000.

5 lakhs u s 87a. This will help the individual to plan their investments in advance and submit necessary documents to their employer in time. The income tax department never asks for your pin numbers passwords or similar access information for credit cards banks or other financial accounts through e mail. 2 how much tax should i pay on my salary.

This calculator calculates taxable income income income tax surcharge health education cess and total tax liability simultneouly under both options opting and not opting for computation of taxable income under section 115bac available to you from the assessment year 2021 22. All resident individuals i e. Income tax slabs show the total tax rate payable by individuals based on their annual earnings from various sources combined. The income tax on your salary will be calculated depending on the tax slab.

Taxable income tax loss is the amount of the income loss for a period determined in accordance with the tax laws based upon which income tax payable recoverable is determined.