How To Calculate Home Loan Interest In Excel

What is home loan emi calculator.

How to calculate home loan interest in excel. Enter the interest payment formula. The amount the interest rate the number of periodic payments the loan term and a payment amount per period. It is important to assess the repayment capability before opting for the loan in order to avoid any financial mess. If you make weekly monthly or quarterly payments divide the annual rate by the number of payment periods per year as shown in this example.

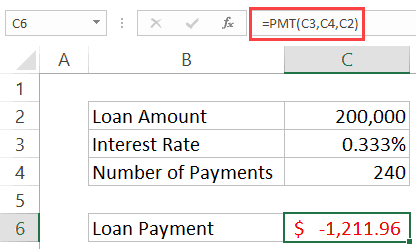

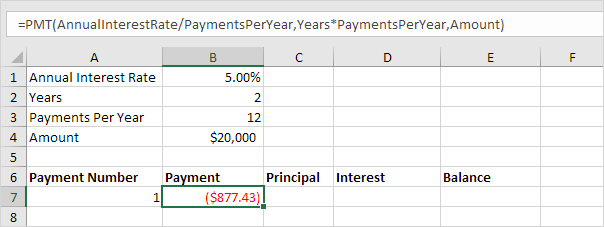

You can use the pmt function to get the payment when you have the other 3 components. Loans have four primary components. One use of the rate function is to calculate the periodic interest rate when the amount number of payment periods and payment amount are known. The amount the interest rate the number of periodic payments the loan term and a payment amount per period.

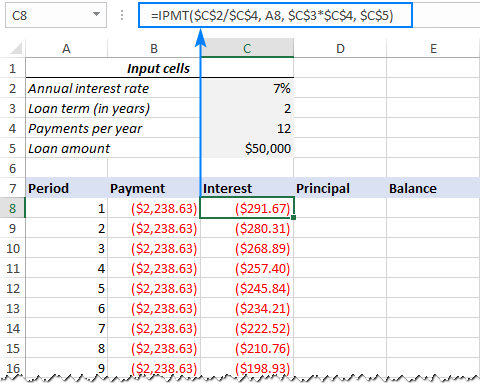

Here s how to calculate amortization schedules for both term loans and traditional amortizing loans. Loan amount tenure and interest rate is customizable in the tool as it can vary from bank to bank. Type ipmt b2 1 b3 b1 into cell b4 and press enter doing so will calculate the amount that you ll have to pay in interest for each period. This doesn t give you the compounded interest which generally gets lower as the amount you pay decreases.

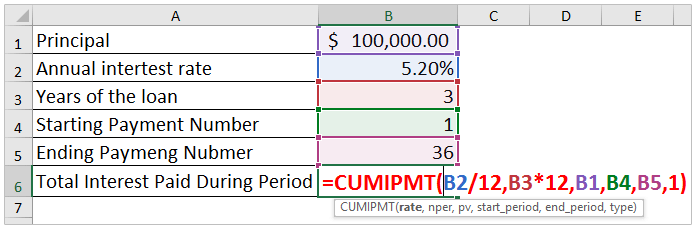

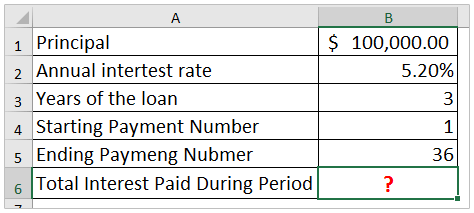

For example if you make annual payments on a loan with an annual interest rate of 6 percent use 6 or 0 06 for rate. Loans have four primary components. Once you ve done this you can also create a payment schedule that uses your data to generate a monthly payment plan to ensure you pay off your mortgage in time. Calculate total interest paid on a loan in excel for example you have borrowed 100000 from bank in total the annual loan interest rate is 5 20 and you will pay the bank every month in the coming 3 years as below screenshot shown.

This wikihow teaches you how to calculate your mortgage related expenses like interest monthly payments and total loan amount using a microsoft excel spreadsheet. For this example we want to find the payment for a 5000 loan with a 4 5 interest rate and a term of 60 months. After each compound period the interest earned over that period is added to the principal so that the next calculation of interest includes the original principal plus the previously earned interest. A home loan emi calculator is an online tool for computing the emi of a home loan.

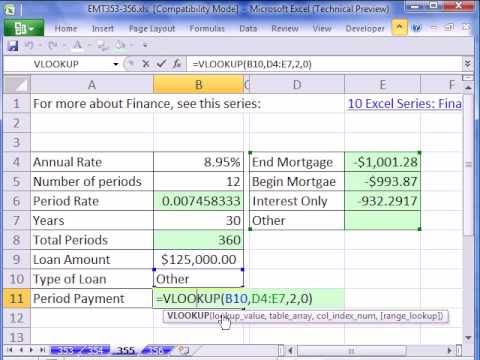

Rate required the constant interest rate per period you can supply it as a percentage or decimal number. How to use excel formulas to calculate a term loan amortization schedule term loans use a different amortizing method than traditional amortizing loans.