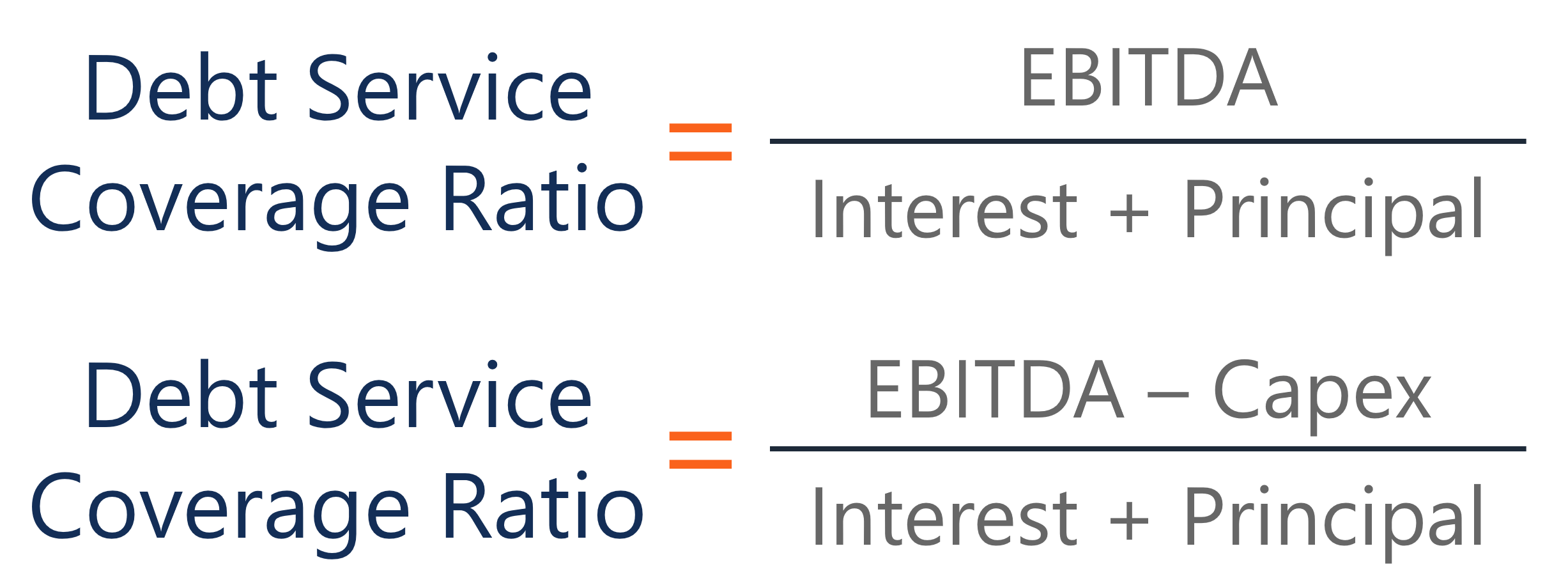

How To Calculate Debt Service Ratio

Dscr is used by an acquiring company in a leveraged buyout leveraged buyout lbo a leveraged buyout lbo is a transaction where a business is acquired using debt as the main source of consideration.

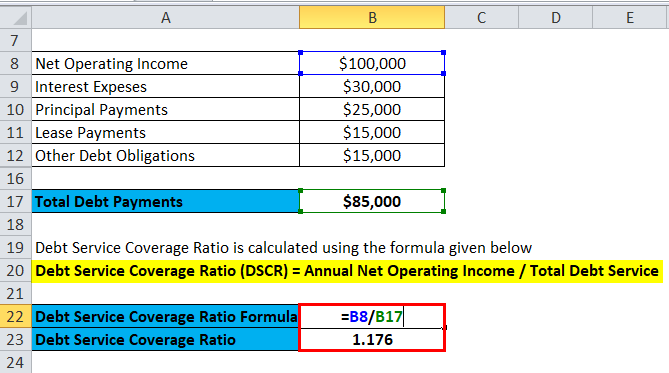

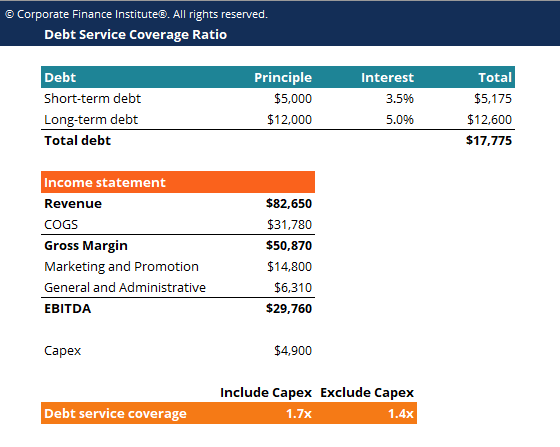

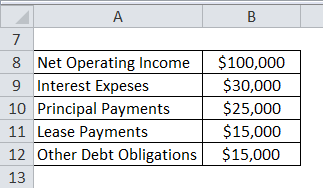

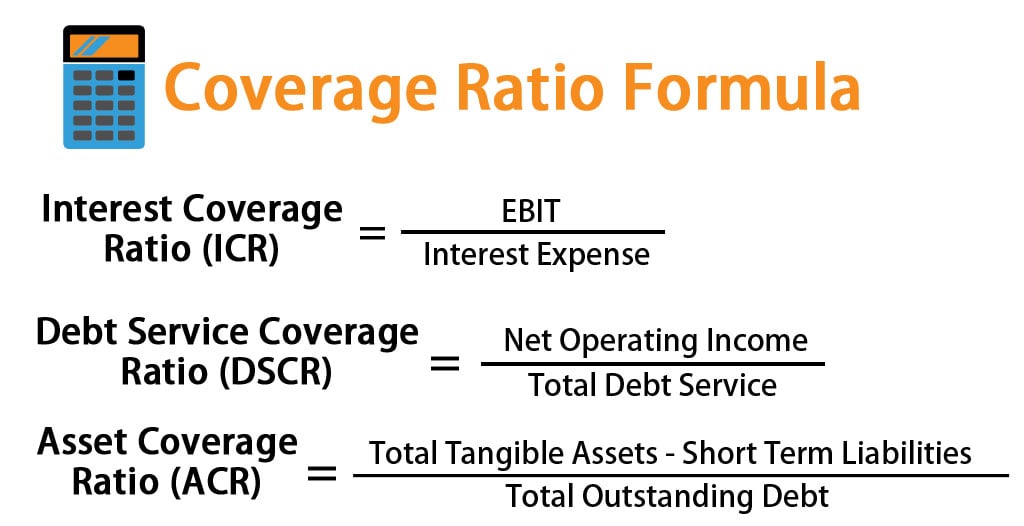

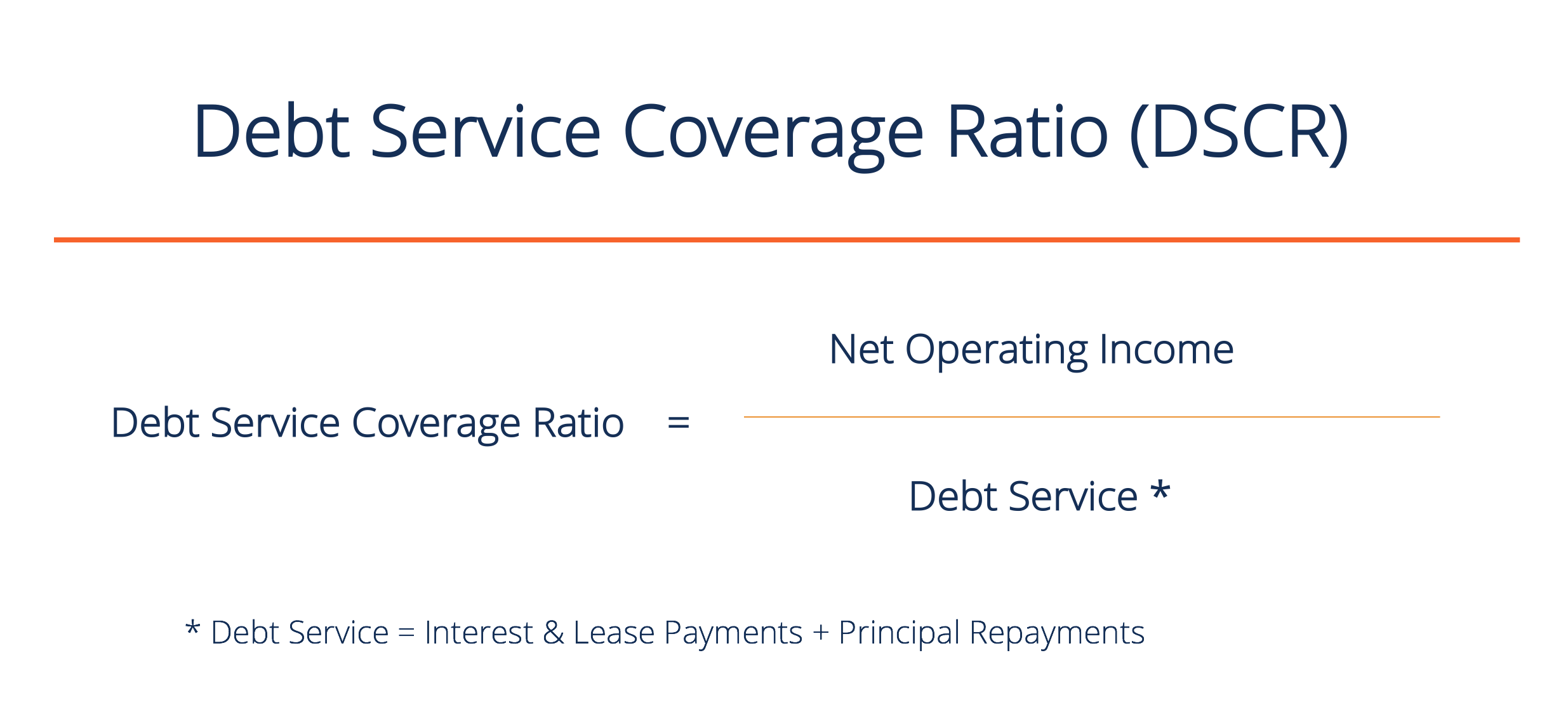

How to calculate debt service ratio. It is calculated by dividing the company s net operating income by its debt obligations for that particular year. It compares income to debt related obligations. The total debt service ratio unlike the gross debt service ratio. For example suppose a rental company generates a net income of 500 000 and has a debt service of 440 000.

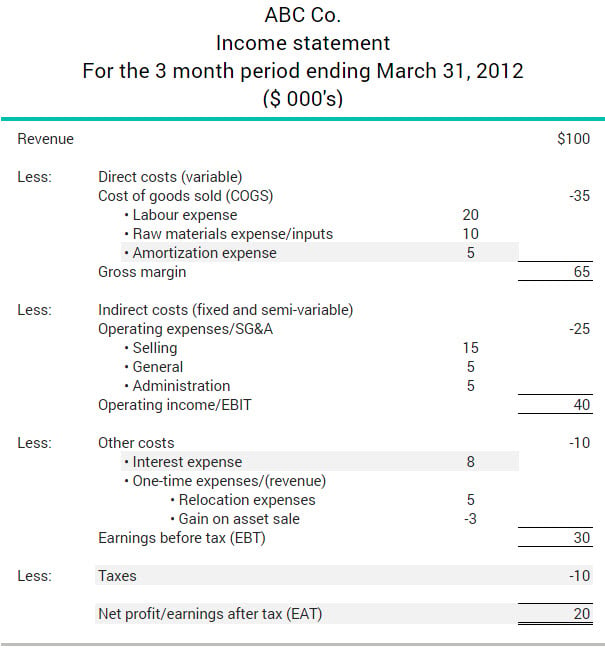

Use the following information and the partial income statement. Bankers often calculate this ratio as part of their considerations of whether or not to approve a business loan. Debt service coverage ratio as its name suggests is the amount of cash a company has to service pay its current debt obligations interest on a debt principal payment lease payment etc. To calculate the debt service coverage ratio simply divide the net operating income noi by the annual debt.

In this case the debt service coverage ratio dscr would simply be 120 000 100 000 which equals 1 20. The total debt service ratio is a lending metric used by mortgage lenders to assess a borrower s capacity to take on a loan. R d expense is 10m less than half of the firm s sg a expense. For example suppose net operating income noi is 120 000 per year and total debt service is 100 000 per year.

Net income total debt service. If your dsr is within the limit you stand a higher chance to receive the loan. 30 years annual payments debt service 758 475. If the debt service coverage ratio is too close to 1 for example 1 1 the entity is vulnerable and a minor decline in cash flow could render it unable to service its debt.

Your dsr is usually compared against the bank s maximum allowable dsr limit. The tax rate is 50. Debt service ratio or dsr is a calculation used by the bank to check whether you can repay the loan. The debt service ratio is one way of calculating a business s ability to repay its debt.

Calculate the debt service coverage ratio dscr. The debt service coverage ratio is a common benchmark to measure the ability of a company to pay its outstanding debt including principal and interest expense.

:max_bytes(150000):strip_icc()/dscr-5c3dfca4c9e77c00010c0b97.jpg)